Which Statement Best Describes Disability Insurance

John does not have adequate short-term disability coverage III. Maximum Monthly Benefit.

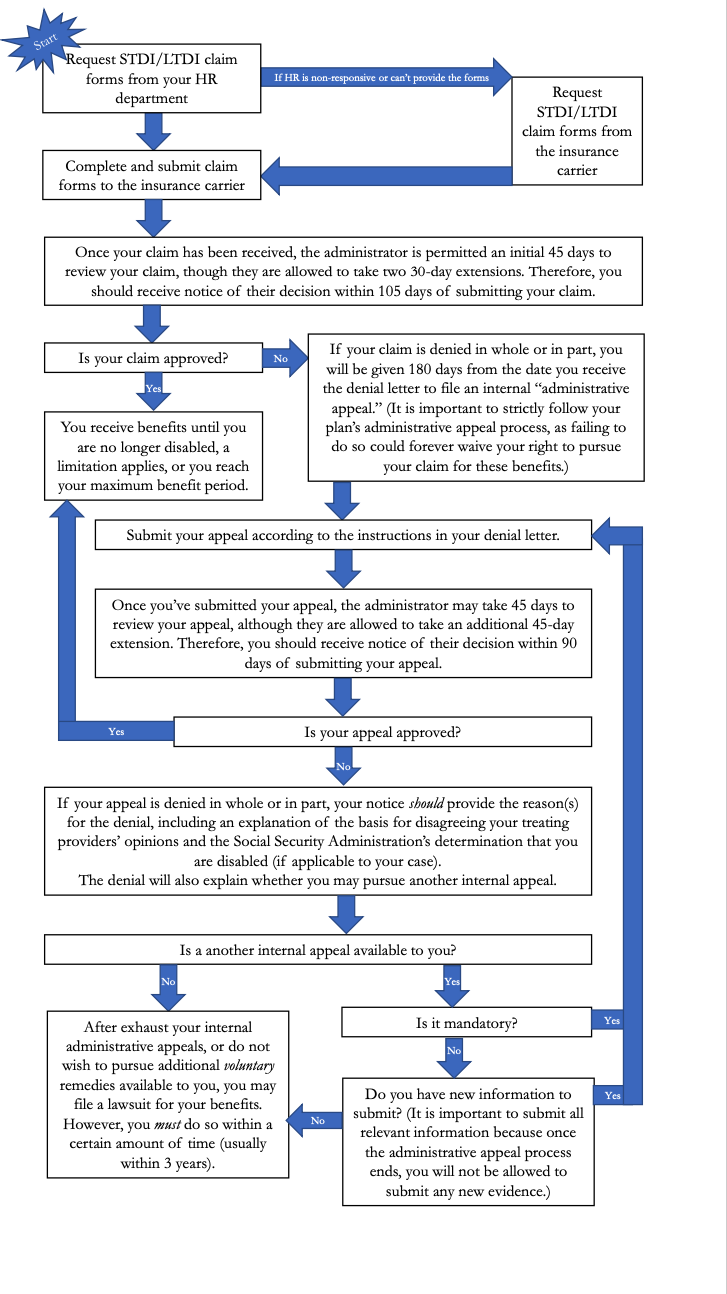

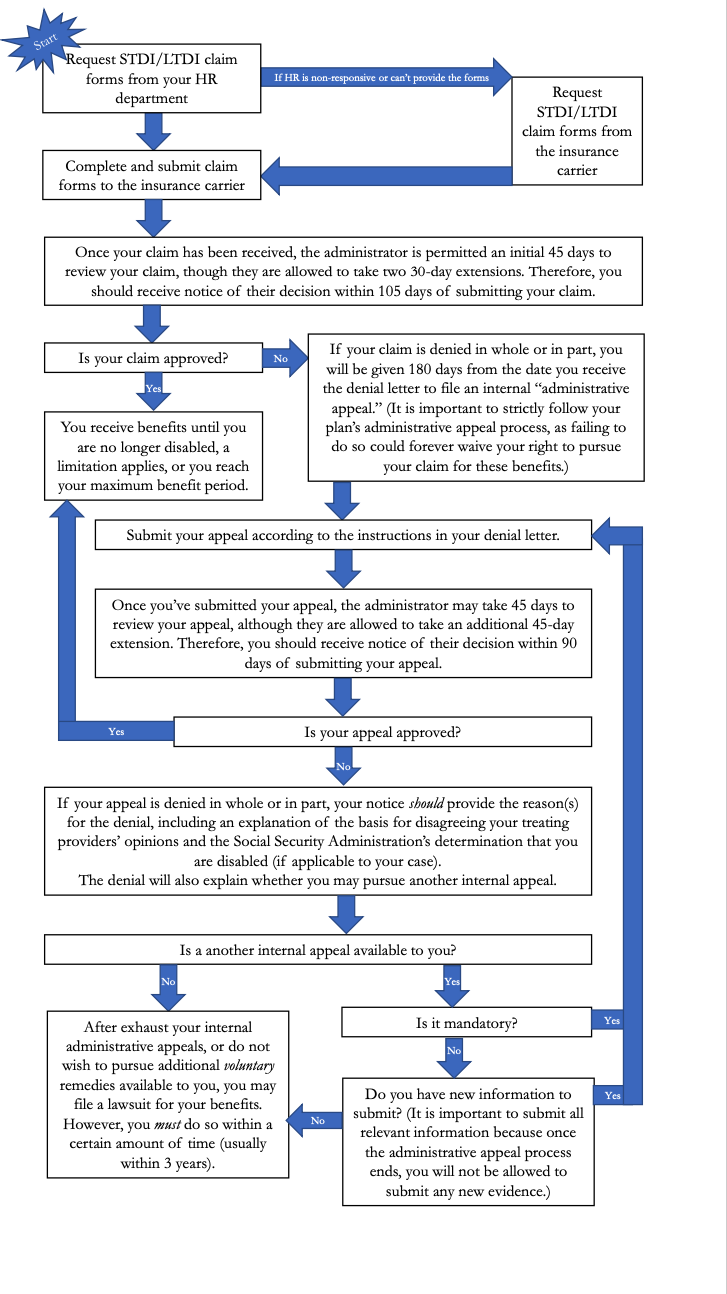

How To Claim Disability Benefits For Mental Health Conditions Hawks Quindel Website

As often deemed necessary.

. A program managed by the Social Security Administration that insures a worker in case of a mishap. The following disability insurance definitions are common words and. Which of the following statements BEST describes Ted and Gayles prospects concerning disability insurance coverage.

In health insurance policies a waiver of premium provision keeps the coverage in force without premium payments. Which of the following statements BEST describes disability buy-sell insurance policies. Benefits are taxable to the business entity b.

Based on the performance of the SP. Disability insurance protects you from the financial risk of losing your income when you become disabled and cant work. John has adequate short-term disability coverage a.

B Individual disability plans are only available on a short-term basis. In an Accident Health policy the insuring clause states the amount of benefits to be paid. Disability insurance offers income protection to individuals who become.

Does Parking Ticket Affect Insurance. Which of the following statements BEST describes disability buy-sell insurance policies. Loses the sight in one eye.

A Disability income insurance benefits are paid out immediately following the disability. If you are self-employed you are not eligible for disability insurance. Through age 59.

The type of coverage where an employer pays the premium for a health policy covering an employee and receives the policy benefits when an employee becomes disabled and is usable to work is known as Key Employee Disability Income. Which of the following statements best describes how a policy that uses the accidental bodily injury definition of an accident differed from one that uses the accidental means definition. Step 4 Physician Validation.

Whether or not the state and local jurisdictions have the resources available to meet the recovery needs B. Disability Income Insurance. The company believes that it will exhaust its retained earnings at 2500000 of capital due to the number of highly profitable projects available to.

Final Exam - Colorado Health and Accident Question 17Select the appropriate response M becomes disabled and is unable to work for six months. Step 3 Ask the Employer to Complete Its Section of the Form. C The extent of benefits is determined by the insureds income.

Earned but unpaid benefits. Loses hearing in one ear. D In long-term plans monthly benefits are limited to 75 of the insureds income.

Through age 59. The principle of indemnification will limit the amount of coverage you can get. Type of Insurance.

After an insured has become totally disabled as defined in the policy After an insured has become totally disabled as defined in the. A Benefits are taxable to the business entity b Premiums are typically tax-deductible c Policy proceeds are typically received tax-free d Benefits are paid to the disabled insured. Disability insurance from an employee group plan is the best source of.

In a disability income contract an insured is considered to be totally disabled under the presumptive disability provision if heshe. Step 2 Complete the Form. The likelihood that similar disaster events will occur in the future affecting the same areas C.

Those are the basics but understanding disability insurance can be confusing if you arent familiar with all of its components. Which of the following statements is CORRECT. D Disability income insurance does not provide a death benefit.

Haley does not need disability coverage at this time IV. M dies soon after from complications arising from this disability. A There are no participation requirements for employees.

Which statement best describes the biggest factor FEMA considers when determining whether to recommend Federal disaster assistance. Hartford Life and Accident Insurance Company. If Ted and Gayle are in the market for a new mortgage they may be able to obtain Creditor Disability Insurance which may be offered with little or no medical underwriting at the time of application.

Hartford Life and Accident Insurance Company. A contingent beneficiary in a life insurance policy has the right toA receive the policy proceeds if the primary beneficiary dies before the insuredB share the policy proceeds with the primary beneficiaryC change the beneficiary designation under specified circumstancesD exercise policy rights if the insured is incapacitated. Disability Income Insurance.

The statement that best describes disability insurance is. Policy proceeds are typically received income tax-free d. Minimum Monthly Benefit.

This type of coverage is known as. B Short-term plans provide benefits for up to 1 year. Ask your HR department for a copy of the form you need to file to claim short-term disability benefits.

M has a Disability Income policy that pays. John has adequate long-term disability coverage II. Key Employee Disability Income.

Which of the following statements best describes the Butterfields disability insurance need at this time. Benefits are paid to the disabled insured. Disability Income Insurance Provate Insurance Plans For Seniors Health Insurance Underwriting Virginia Laws And Rules Final Chapter Exam.

As its name suggests disability insurance is a type of insurance product that provides income in the event that a policyholder is prevented from working and earning an income due to a disability. Which statement accurately describes group disability income insurance. What Is Disability Insurance.

Premiums are typically tax-deductible c. Loses the use of one hand. C Group disability plans are only available on a long-term basis.

Step 5 Submit the Form. In the United States individuals can obtain disability insurance from the government through the Social Security System. At least once per year from when benefits begin.

1 pt 1 of 50 0 complete Which of the following statements is true regarding disability insurance.

What Do I Do If I Can T Get Answers From My Insurance Company Patient Advocate Foundation Medical Debt Emergency Care Insurance Company

Health Insurance How To Fight Back Against 4 Common Claim Denials Health Insurance Options Health Insurance Companies Best Health Insurance

Infographic Healthcare Assistance For Disabled Americans Health Care Social Security Disability Disability

Disability Insurance Coverage Types Simplified Guide Trusted Choice

No comments for "Which Statement Best Describes Disability Insurance"

Post a Comment